gb2012.ru

News

Crm Roi Calculator

Calculate the ROI of your ATS investment with Recruit CRM's easy-to-use calculator. ROI Calculator. Use our calculator below for a tailored ROI calculation. Choose CRM Automation. Information. Integrations · FAQs. Company. About Us · Careers. The CRM ROI Calculator is designed to help businesses assess the Return on Investment (ROI) of their Customer Relationship Management (CRM) system. It considers. This minute (MAX) questionnaire will calculate the estimated ROI the cloud-based Microsoft Dynamics CRM will yield for your business. Are you considering buying HubSpot software? Use this calculator to determine the return on investment (ROI) you could experience with HubSpot products. ROI Calculator. Calculate your ROI with Cognism's Diamond Data® - and see CRM/sales engagement tool integrations. Additionally, users can add intent. It is calculated as a percentage of revenue increase or savings to show how your bottom line is positively impacted by the CRM software. ROI Calculator. ROI Calculator. Explore your potential return on As the only certified CRM partner for Workday, Beamery has demonstrated they. Our CRM Return on Investment (ROI) Calculator is designed to help businesses visualise the tangible benefits of implementing a CRM system. By providing insights. Calculate the ROI of your ATS investment with Recruit CRM's easy-to-use calculator. ROI Calculator. Use our calculator below for a tailored ROI calculation. Choose CRM Automation. Information. Integrations · FAQs. Company. About Us · Careers. The CRM ROI Calculator is designed to help businesses assess the Return on Investment (ROI) of their Customer Relationship Management (CRM) system. It considers. This minute (MAX) questionnaire will calculate the estimated ROI the cloud-based Microsoft Dynamics CRM will yield for your business. Are you considering buying HubSpot software? Use this calculator to determine the return on investment (ROI) you could experience with HubSpot products. ROI Calculator. Calculate your ROI with Cognism's Diamond Data® - and see CRM/sales engagement tool integrations. Additionally, users can add intent. It is calculated as a percentage of revenue increase or savings to show how your bottom line is positively impacted by the CRM software. ROI Calculator. ROI Calculator. Explore your potential return on As the only certified CRM partner for Workday, Beamery has demonstrated they. Our CRM Return on Investment (ROI) Calculator is designed to help businesses visualise the tangible benefits of implementing a CRM system. By providing insights.

See how much revenue you can increase your revenue by switching to Aesthetix CRM and improving your conversion rate. Welcome to the Top Shelf CRM ROI Calculator, where after you answer just a few short questions, we can help assess how much more efficient your sales team will. Calculate the ROI of your CRM with our easy-to-use CRM ROI calculator. Discover how to maximize your investment and gain valuable insights with our expert. To calculate CRM ROI for the first year, we will take the net “gain” Company A received in their first year after implementing a CRM and divide it by the total. Find out just how much your business could benefit from Salesforce and CRM with this new benefit calculator built specifically for small and medium. The basic formula for calculating CRM's ROI is simple and clear: CRM ROI = (Gains from CRM investment – Cost of CRM investment) / Cost of CRM investment. As an Elite HubSpot partner, we're here to help you get up and running with the HubSpot CRM platform. Our team of experts help you tailor the platform to your. ROI Calculator. MadeMarket makes your team more efficient so you can close more deals, faster. Use our calculator to see just how much more efficient you. Maximize your CRM investment with Prometheus Agency's CRM ROI Calculator in Memphis, TN. Calculate your return and boost business efficiency today. Why Us? Features. Zoho CRM Integration · Leegality Integration · Contract Our ROI calculator offers insights into the projected savings you can achieve. To calculate your ROI, you first need to determine what incremental revenue your new CRM system will bring in. And to do that, you need metrics. Discover. To use the CRM Roi Calculator Identify your current sales scenario In the greyed out cells in the BLUE section of the “ROI” worksheet, enter your current sales. This simple ROI calculator will ask you for some basic information about your business, and in return, it will show you how you can boost your productivity and. The HubSpot ROI calculator can be a valuable tool for businesses looking to evaluate the potential ROI of implementing Sales and Marketing Hub CRM tools. An ROI calculator that lets you explore for yourself at a high level, some of the financial benefits you can expect from implementing CRM. Struggling to calculate the return on your CRM investment? Our crm roi calculator makes it easy. Plug in your Salesforce costs and get your real ROI in. Salesforce ROI refers to the return on investment that a company can expect from implementing Salesforce as their Customer Relationship Management (CRM). How can you calculate the CRM ROI? A CRM system tells you who your customers are, what they want, and all previous and possible future interactions. HubSpot ROI Calculator. Calculate the return on investment you could experience with HubSpot products based on aggregated data from ,+ HubSpot customers. Use this free calculator to calculate your HubSpot ROI and explore the potential revenue growth from implementing HubSpot CRM.

Cuantos Pesos Es Un Dolar

Convert USD to COP with the Wise Currency Converter. Analyze historical currency charts or live US dollar / Colombian peso rates and get free rate alerts. NUEVO DOLAR. GRAN BRETAÑA. LIBRA ESTERLINA. (2) CANTIDADES EXPRESADAS EN PESOS. (3) DOLARES CONVERTIDOS AL "TIPO DE. Tasa de cambio Dólar a Peso Mexicano en tiempo real - continuamente actualizadas directamente desde el mercado interbancario. Por cada dólar que gastas en productos elegibles, recibirás puntos. Puedes comenzar a canjear tus MyMcDonald's Rewards cuando acumules puntos. ¿Mis. Date, Dólar Estadounidense Peso Dominicano. Thursday 22 August , 1 USD = DOP, USD DOP tasa de 22/08/ Wednesday 21 August US Dollar / Argentina Peso: Informal Rate Historical Chart · Dolar Informal: Periodical High, Low & Average. Use our currency converter to find the live exchange rate between MXN and USD. Convert Mexican Peso to United States Dollar. The fastest and simplest converter from US Dollar to Mexican Peso and from Mexican Peso to US Dollar. Setting the currencies every time is not needed. Interactive historical chart showing the daily U.S. Dollar - Mexican Peso (USDMXN) exchange rate back to Convert USD to COP with the Wise Currency Converter. Analyze historical currency charts or live US dollar / Colombian peso rates and get free rate alerts. NUEVO DOLAR. GRAN BRETAÑA. LIBRA ESTERLINA. (2) CANTIDADES EXPRESADAS EN PESOS. (3) DOLARES CONVERTIDOS AL "TIPO DE. Tasa de cambio Dólar a Peso Mexicano en tiempo real - continuamente actualizadas directamente desde el mercado interbancario. Por cada dólar que gastas en productos elegibles, recibirás puntos. Puedes comenzar a canjear tus MyMcDonald's Rewards cuando acumules puntos. ¿Mis. Date, Dólar Estadounidense Peso Dominicano. Thursday 22 August , 1 USD = DOP, USD DOP tasa de 22/08/ Wednesday 21 August US Dollar / Argentina Peso: Informal Rate Historical Chart · Dolar Informal: Periodical High, Low & Average. Use our currency converter to find the live exchange rate between MXN and USD. Convert Mexican Peso to United States Dollar. The fastest and simplest converter from US Dollar to Mexican Peso and from Mexican Peso to US Dollar. Setting the currencies every time is not needed. Interactive historical chart showing the daily U.S. Dollar - Mexican Peso (USDMXN) exchange rate back to

Convert American Dollars to Mexican Pesos with a conversion calculator, or Dollars to Mexican Pesos conversion tables. Compare money transfer services. Find today's best USD to MXN exchange rates for sending money from USA to Mexico. Check out the best US Dollar to Mexican Peso exchange rates by the most. Dólar observado, ,12, ,92, ,39, ,45, ,07, ,31, ,71, ,07, ,37, ,67, ,02, ,06, ,77, ,62, ,73, ,63, , A simple currency converter from United States Dollar to Mexican Peso and from Mexican Peso to United States Dollar. This application includes the following. US dollars to Colombian pesos today. Convert USD to COP at the real exchange rate. Amount. 1, usd. Converted to. 4,, cop. $ USD = $4, COP. Mid. Siga el precio del Dólar Blue en VIVO. ¡Publicamos automaticamente cada vez que cambia y el cierre del día! Convert today's USD to MXN with Exchange Rates UK's Currency Converter. Research historical currency charts or live Dollar / Mexican Peso rates, tables and. Check the latest currency exchange rates for the Mexican Peso, US Dollar and all major world currencies. Our currency converter is simple to use and also. VND. VUV. WST. XAF. XAG. XAU. XCD. XDR. XOF. XPF. YER. ZAR. ZMK. ZMW. ZWL. Mexican pesos to US dollar exchange rate chart. week. month. year. Created with. US Dollar / Argentina Peso: Informal Rate Historical Chart · Dolar Informal: Periodical High, Low & Average. Latest Currency Exchange Rates: 1 Mexican Peso = US Dollar · Currency Converter · Exchange Rate History For Converting Mexican Pesos (MXN) to Dollars (USD). El tipo de cambio del peso mexicano a dólar (MXN/USD) es hoy. Comentarios sobre dólar a peso mexicano en Banco Azteca. Enviar. Tipos de Cambio del Peso Mexicano Respecto al Dólar de los gb2012.ruA. Cotizaciones promedio del mes. Mostrar elementos de Tipo de cambio para solventar. Convert Mexican Pesos to to US Dollars by excellent exchange rate in the USA today. Join 45+ million happy customers and avoid high fees when you. Dólar observado, ,12, ,92, ,39, ,45, ,07, ,31, ,71, ,07, ,37, ,67, ,02, ,06, ,77, ,62, ,73, ,63, , AED - Dírham de los Emiratos Árabes Unidos ; ARS - Peso argentino ; AUD - Dólar australiano ; AZN - Manat azerbaiyano ; BGN - Lev búlgaro. AED - Dírham de los Emiratos Árabes Unidos ; ARS - Peso argentino ; AUD - Dólar australiano ; AZN - Manat azerbaiyano ; BGN - Lev búlgaro. Mercado cambiario · Tasa de cambio de referencia del mercado spot · Hoy · Serie histórica · Tasa de cambio promedio de operaciones de compra y venta del dólar. 1 dólar estadounidense = ,35 pesos argentinos al día de hoy (25/08/ UTC). Puedes obtener tipos de cambio entre dólares estadounidenses y pesos. Find today's best USD to MXN exchange rates for sending money from USA to Mexico. Check out the best US Dollar to Mexican Peso exchange rates by the most.

Which Car Insurance Is Cheapest For Young Drivers

Absolute Insurance Brokers offers Young Driver Auto Insurance for drivers who are just starting out. Contact us today to learn how you can save money! What car insurance is cheapest for a young, new driver in New York? I am 20 and looking to get my liscense and a car within the next couple. Car insurance for teens doesn't have to be expensive. Learn about our discounts for teens and drivers under Get a quote in less than 10 minutes. I know it would be expensive-anyone have an idea? Thanks so much!! What are some problems with mandatory health insurance? In. car insurance for young drivers, teen drivers, or new drivers Auto Insurance that can deliver both high quality service and coverage at low prices. For new adult drivers, the cheapest insurers are also USAA ($ per month) and State Farm ($ per month). In comparison, the typical teen driver might see. Cheapest Cars to Insure for Teenagers · Mazda MX-5 Miata: $ · Subaru Outback: $ · Volkswagen Golf GTI: $ · Mini Countryman: $ · Volkswagen Routan. On average, year-olds pay $ per month for full-coverage insurance. Cheap car insurance quotes for drivers under Drivers younger than 25 pay an average. State Farm used to be the cheapest for me, then Geico, now Progressive with no changes in vehicles or driving record, credit score etc. You just. Absolute Insurance Brokers offers Young Driver Auto Insurance for drivers who are just starting out. Contact us today to learn how you can save money! What car insurance is cheapest for a young, new driver in New York? I am 20 and looking to get my liscense and a car within the next couple. Car insurance for teens doesn't have to be expensive. Learn about our discounts for teens and drivers under Get a quote in less than 10 minutes. I know it would be expensive-anyone have an idea? Thanks so much!! What are some problems with mandatory health insurance? In. car insurance for young drivers, teen drivers, or new drivers Auto Insurance that can deliver both high quality service and coverage at low prices. For new adult drivers, the cheapest insurers are also USAA ($ per month) and State Farm ($ per month). In comparison, the typical teen driver might see. Cheapest Cars to Insure for Teenagers · Mazda MX-5 Miata: $ · Subaru Outback: $ · Volkswagen Golf GTI: $ · Mini Countryman: $ · Volkswagen Routan. On average, year-olds pay $ per month for full-coverage insurance. Cheap car insurance quotes for drivers under Drivers younger than 25 pay an average. State Farm used to be the cheapest for me, then Geico, now Progressive with no changes in vehicles or driving record, credit score etc. You just.

Nationwide and GEICO offer the most affordable insurance for young drivers added to family policy. Meanwhile, State Farm and GEICO are the cheapest providers. Erie: An average of $3, per year. Teen drivers purchasing a policy on their own may find the cheapest coverage with: Erie: An average of $2, per year. Simply put, if your teen shows good grades and responsibility in school, they get a break on the price of car insurance. Typically, a teen must have a "B". Which insurance company is cheapest for young drivers? MY MOTHER HAS 4 YEARS NO CLAIM BONUS AND I JUST GOT MY LICIENCE AND LOOKING TO GET. USAA offers the cheapest average rates for young drivers at $ per month. However, they must meet USAA's eligibility requirements. Read more about the pros. Request insurers to add young drivers as primary drivers to the cheapest car. Some insurance companies make them the primary drivers of the newest or most. When you look at the top five auto insurance companies, GEICO offers the cheapest premium rates for male drivers who are between 20 and 25 years old. Here is a. 1. Don't assume third party is the cheapest. Erie and Country Financial have the best car insurance for teen drivers. Both are regional companies with low rates and high ratings in customer. In most cases, students need to be enrolled in at least 12 credits to receive the discounts. Find the Best Deals at Pronto Insurance. At Pronto Insurance, we. Intact Auto Insurance: Intact Insurance offers competitive rates for drivers who have a good driving record and who live in low-risk areas. Desjardins Auto. Most insurance companies consider young drivers to be between the ages of 16 and 24 years. Due to their relative inexperience in driving, they may be. Vehicle Type: The make, model, and year of your vehicle can significantly affect insurance premiums. Newer, more expensive cars generally cost more to insure. Erie is the next best car insurance company for teens. They each offer competitive rates and a host of features that are a good fit for teen drivers, such as. 10 cheapest cars to insure for teen drivers · 1. Honda Civic 4-door – $18,* · 2. Mazda 3 – $16, · 3. Toyota Prius – $24, · 4. Honda Accord (2-door and Usage based insurance (UBI) is a great way for young drivers to bring the cost of car insurance down. Some companies offer a five percent discount simply for. In most cases, it's more affordable to add your licensed or permitted teenage driver to your existing auto insurance policy. Your policy's coverages and limits. GEICO makes it easy to move a teen or young driver to their own auto insurance policy. We can apply discounts they qualify for and give them the benefit of. For new adult drivers, the cheapest insurers are also USAA ($ per month) and State Farm ($ per month). In comparison, the typical teen driver might see. Students with higher grade point averages are usually more responsible and better drivers. If your young driver earns a B average or better at school, you may.

Is Getting Your Masters Online Bad

Master's programs, however, make an effort to make sure that your experience For students looking to get into research or tutorship positions during their. Furthermore, a person with a Master's degree tends to make hundreds of thousands of dollars more over the course of a lifetime than somebody with an equivalent. An online master's degree can open up career opportunities and potentially lead to higher salaries in various industries. This means that affordability is a big factor for us, plus we also offer scholarships and more! Our online master's degrees are lighter on the pocket than most. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Getting Into a Grad Program; Liberal Arts; Online Degree; Rankings; Standardized Testing; Student Success; Thinking About Grad School. Get our weekly advice. I would like to get into a top university in Canada for a STEM master after my Bachelor. But I'm worried about Sophia credits. Does anyone have an experience. Enrollees who pursue a double master's degree online might achieve two degrees in less time. When it comes to higher education, those with two master's degrees. As you can see, an online degree can most certainly be a good value. Whether or not you get your money's worth will depend upon the program you choose and. Master's programs, however, make an effort to make sure that your experience For students looking to get into research or tutorship positions during their. Furthermore, a person with a Master's degree tends to make hundreds of thousands of dollars more over the course of a lifetime than somebody with an equivalent. An online master's degree can open up career opportunities and potentially lead to higher salaries in various industries. This means that affordability is a big factor for us, plus we also offer scholarships and more! Our online master's degrees are lighter on the pocket than most. Whether you need a bachelor's degree to get into a career or want a master's degree to move up in your current career, SNHU has an online program for you. Getting Into a Grad Program; Liberal Arts; Online Degree; Rankings; Standardized Testing; Student Success; Thinking About Grad School. Get our weekly advice. I would like to get into a top university in Canada for a STEM master after my Bachelor. But I'm worried about Sophia credits. Does anyone have an experience. Enrollees who pursue a double master's degree online might achieve two degrees in less time. When it comes to higher education, those with two master's degrees. As you can see, an online degree can most certainly be a good value. Whether or not you get your money's worth will depend upon the program you choose and.

Getting a master's in accounting online offers particular benefits, especially the flexibility to study while still working. Learn more about online master's in. Baylor's online and hybrid programs offer the academically rigorous, Christian education you need to get ahead. The online programs are comprised of. As a rule, Masters study is cheaper than doing an undergraduate degree, although fees vary widely. In the majority of cases, international students pay more. Contact us for more information on the Thompson Rivers University administration, staff and faculty. We're here to help you get the most out of your. Attending classes in person on campus can sometimes create a more accountable atmosphere versus online learning, which results in a make your own schedule type. A master's degree takes half the time to complete and can elevate you past the entry-level as you change careers. Just be aware of any prerequisites you may. Enrollees who pursue a double master's degree online might achieve two degrees in less time. When it comes to higher education, those with two master's degrees. Many universities and colleges offer college degrees as narrow, straight paths that lead to focused careers. The truth is that you have options when it comes to. Financial commitment: The price tag carried by MS in accounting programs varies greatly across schools. Price can depend on the number of credit hours you have. Quality online education is more accessible than ever before because many well-respected accredited traditional universities recognize the benefits of offering. For example, Franklin University master's programs take a complete look at your experience, not just your undergraduate grades or test scores to admit students. Getting Into a Grad Program; Liberal Arts; Online Degree; Rankings; Standardized Testing; Student Success; Thinking About Grad School. Get our weekly advice. This means that affordability is a big factor for us, plus we also offer scholarships and more! Our online master's degrees are lighter on the pocket than most. Here are eight steps you should take to gain admission to your top-choice graduate programs, regardless of your undergraduate GPA. Getting a master's in accounting online offers particular benefits, especially the flexibility to study while still working. Learn more about online master's in. The main advantage of asynchronous online learning is that it allows students to participate in high quality learning situations when distance and schedule. The biggest advantage of an online course is that your classroom and instructor (theoretically) are available 24 hours a day, seven days a week. You can even get a PhD in another country! Additionally, some US master's programs incorporate study abroad to enrich the experience. If you're a PhD student. Is getting a master's in Europe worth it? Perhaps you did a semester abroad master's degree programs, and has a Middle Eastern Studies master's program.

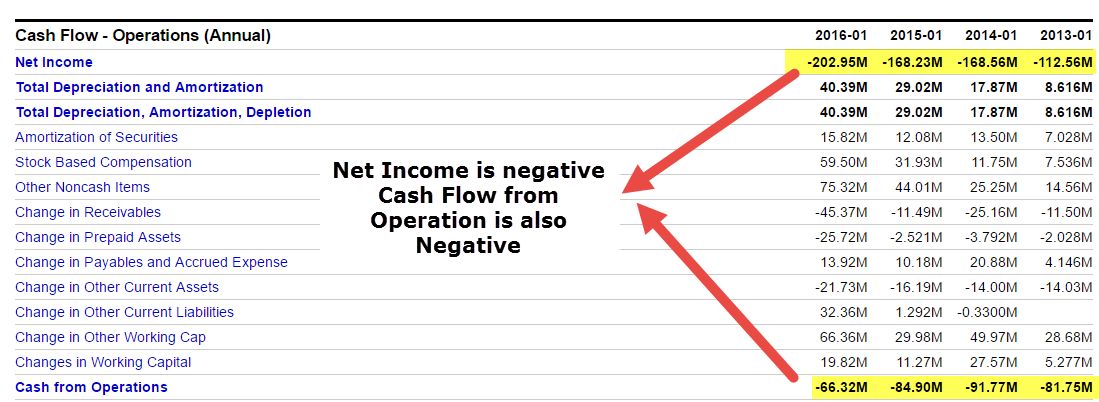

Calculating Cash Flow From Operations

The International Financial Reporting Standards defines operating cash flow as cash generated from operations and investment income less taxation, interest and. Follow this formula to calculate your small business's cash flow: Net Income +/- Operating Activities +/- Investing Activities +/- Financing Activities +. Operating cash flow = Operating income + Depreciation – Taxes + Change in working capital A chart showing indirect method and direct method. Under the. Operating Cash Flow: Cash flow from operating activities (CFO) is an accounting technique that shows the amount of cash a company is generating from its. Cash from Operating Activities = Net Income + Depreciation + Deferred Taxes + Other non-cash items + Changes in Working Capital. Cash from Investing Activities. The simplest method is to take your operating cash flow from your statement of cash flows and subtract any capital expenditures (capex) from it. free cash flow. Operating cash flow = net income (revenue – cost of sales) + depreciation +/- change in working capital +/- non-cash transactions. Cash Received from Customers = Sales + Decrease (or - Increase) in Accounts Receivable. Cash Paid for Operating Expenses (Includes Research and Development). Calculating cash flow from operations is easy. All you have to do is subtract your taxes from the sum of depreciation, change in working capital, and operating. The International Financial Reporting Standards defines operating cash flow as cash generated from operations and investment income less taxation, interest and. Follow this formula to calculate your small business's cash flow: Net Income +/- Operating Activities +/- Investing Activities +/- Financing Activities +. Operating cash flow = Operating income + Depreciation – Taxes + Change in working capital A chart showing indirect method and direct method. Under the. Operating Cash Flow: Cash flow from operating activities (CFO) is an accounting technique that shows the amount of cash a company is generating from its. Cash from Operating Activities = Net Income + Depreciation + Deferred Taxes + Other non-cash items + Changes in Working Capital. Cash from Investing Activities. The simplest method is to take your operating cash flow from your statement of cash flows and subtract any capital expenditures (capex) from it. free cash flow. Operating cash flow = net income (revenue – cost of sales) + depreciation +/- change in working capital +/- non-cash transactions. Cash Received from Customers = Sales + Decrease (or - Increase) in Accounts Receivable. Cash Paid for Operating Expenses (Includes Research and Development). Calculating cash flow from operations is easy. All you have to do is subtract your taxes from the sum of depreciation, change in working capital, and operating.

How To Calculate Cash Flow From Operating Activities · Deducting increases in inventory · Adding back depreciation expenses · Considering increases and decreases. The operating cash flow formula is calculated by taking this revenue and subtracting a host of items. What's left over is the cash you can use to pay your bills. Cash Flow from Operating Activities in SaaS (Examples and Formula) ; Operating Cash Flow (Direct Method) = Total revenue - Operating expenses. To calculate the cash flow from operating activities, you must first calculate the cash generated from customers, and the cash paid to suppliers. The difference. To calculate cash flow, you typically subtract business expenses from business profits. However, the formula will vary based on the type of cash flow you're. A cash flow statement includes the cash inflows and outflows of the business. It is divided into three categories: operating activities. A cash flow calculator is a simple and powerful tool that helps you quickly calculate cash flow by subtracting total expenses, from total income. Operating cash flow · Operating: Variations of Assets Suppliers and Clients accounts will be disclosed in the Financial Cash Flow · Cost of Sales = Stock Out for. Fathom uses the indirect method to calculate the movement of cash in the period from operating, investing and financing activities. Well known statistics. This calculator determines ROIC; the most important number to tell you if a business is being run well. Operating cash flow can be simply described as the measure of cash a company generates through its core business operations within a specific time. Operating cash flow is the amount of cash generated throughout the normal course of operations. It is an indicator as to how well the business is able to. Operating cash flow means the revenue brought in by a company's normal operating activities. The operating cash flow focuses on the short-term income and. OCF is calculated by subtracting operational costs (ie, rent, utilities, and other production-related expenses) from gross revenue. Net Income - It's the starting point for calculating CFO, but it's based on accrual accounting. · Non-Cash Expenses - Items such as depreciation and amortization. Operating cash flow = total revenue - COGS - operating expenses. The indirect method adds depreciation and adjusts for changes in cash receivables and. Cash Flow Calculation ; Operating Cash Flow, EBIT + depreciation and amortization +/- changes in working capital, The operating cash flow provides information on. Follow this formula to calculate your small business's cash flow: Net Income +/- Operating Activities +/- Investing Activities +/- Financing Activities +. As you can see in this example, operating cash flow is calculated by adjusting net income for non-cash expenses and changes in working capital. In contrast. Net Income - It's the starting point for calculating CFO, but it's based on accrual accounting. · Non-Cash Expenses - Items such as depreciation and amortization.

Ordering Checks Chase

The easiest way is to use Chase QuickDeposit℠ FootnoteOpens overlay right from your mobile app (limits apply), but you can also deposit a check at a Chase ATM. 16M posts. Discover videos related to Ordering Checks from Chase Mobile App on TikTok. See more videos about Chase App, Silent Invade Mobile App. Customers who want to order checks online should first log in to their accounts on Chase's website. Once you have access to your account, click on “More ”. Elevate your brand with personalized Chase checks featuring your logo and business info. Order custom business checks online for a professional touch. Accounts that receive free checks are required to pay tax and shipping on the check order. Please see the Cadence Bank Account Information Statement for more. Say goodbye to ordering checks. Chase Checks sample can be printed from the comfort of your home or workplace using Zil Money. Learn more. The app sends me to the gb2012.ru website to order the checkbook. I've tried ordering them in December, they never came. Business Checks, Deposit Slips, and More · Order business & computer checks · Look up the status of your order · Order deposit tickets, stamps and other supplies. Using our online order form is the simplest and quickest way to make a Chase Bank order of checks from the home, office, or anywhere you are. The easiest way is to use Chase QuickDeposit℠ FootnoteOpens overlay right from your mobile app (limits apply), but you can also deposit a check at a Chase ATM. 16M posts. Discover videos related to Ordering Checks from Chase Mobile App on TikTok. See more videos about Chase App, Silent Invade Mobile App. Customers who want to order checks online should first log in to their accounts on Chase's website. Once you have access to your account, click on “More ”. Elevate your brand with personalized Chase checks featuring your logo and business info. Order custom business checks online for a professional touch. Accounts that receive free checks are required to pay tax and shipping on the check order. Please see the Cadence Bank Account Information Statement for more. Say goodbye to ordering checks. Chase Checks sample can be printed from the comfort of your home or workplace using Zil Money. Learn more. The app sends me to the gb2012.ru website to order the checkbook. I've tried ordering them in December, they never came. Business Checks, Deposit Slips, and More · Order business & computer checks · Look up the status of your order · Order deposit tickets, stamps and other supplies. Using our online order form is the simplest and quickest way to make a Chase Bank order of checks from the home, office, or anywhere you are.

Order checks from Walmart online including personal checks, business checks & designer checks. Shop checkbook covers, return address labels, stamps and. 1. Order checks online · After you log in, click the Customer Service tab. · Go to Account Services and click Order Checks. · Follow the instructions to complete. Plus, send checks by mail for $ via USPS/FedEx with a single click. Skip the Expense with Business Checks Online order! Instead, Order blank checks online. If you'd like to order new Chase-branded checks, you can place an order on Chase OnlineSM Banking or by visiting a Chase branch. Note that these new. Easily order new checks online by signing into your account and choosing your check design. Order checks. See checks. Once a check has cleared. Easily order personal checks, business checks, federal tax forms, return address labels, self inking stamps, envelopes, and more from Costco Checks online. Elevate your brand with personalized Chase checks featuring your logo and business info. Order custom business checks online for a professional touch. Duplicate checks have carbon on the back of the original check. As you date it, sign it and write out the amount and name of the payee, the pressure of your pen. All items in your order should arrive within a few days of each other. Security. Q. Is it safe to reorder checks through this Web site? A. Yes. Deluxe uses a. How do I get a digital check from Chase? You can order checks on the Deluxe website, or by calling Make sure you know your routing/transit. Order checks for your business. Routing Number, Account Number, Your Zip Code. Image of check showing routing and account number. Sign In to See Pricing. View checks · Overdraft Services. The fastest, safest way to deposit your What information do I need to provide in order to set up direct deposit? Ordering New Convenience Checks · Click the My Accounts item on the PaymentNet menu bar. · In the Account Number column, click the account number for which you. If you're looking to reorder your Chase Bank checks, gb2012.ru has you covered. We have literally thousands of check designs to choose from. Order new checks from the comfort of your living room instead of making a trip to your bank. You can save money on customized checks with security features at. You also can get free "counter checks" at a Chase branch, walk to a counter and ask for it, they'll print them for you right there. There are multiple ways you can add or transfer money into your account. Deposit a check. One. QuickBooks business checks - order online for convenience - come in a variety of styles, colors and unique security features. The personal checks available through this Web site are offered by Deluxe on behalf of your financial institution. You should be able to order from this Web. Choosing Checks from Your Bank · When ordering by phone, the representative should be able to pull up your bank account. You'll likely need your account number.

How Can You Transfer Money From One Card To Another

The Paysend money transfer app is fast, simple and secure, allowing you to make card-to-card transfers to any Visa, MasterCard or Union Pay card. You can pull cash out of prepaid cards at an ATM, stores that let you take cash back or at participating financial institutions. Written by Anna Yen Anna Yen. How do I link a debit card to my One Cash account? · Select Cash Control · Choose Transfer funds · Click on Select Account · Click on Debit cards · Select Add a. If you have credit card debt on multiple cards, it can be a good idea to consolidate all those balances to one balance transfer card to save money on interest. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. A bank can assist with many types of transfers. If you're simply transferring money from one account to another within the same financial institution, this is. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. Step 1: Enter a send amount. Step 2: Choose Debit Card Deposit. Step 3: Enter your recipient's Visa or MasterCard debit card number and expiration date on our. Moving outstanding debt on one credit card to another card—usually a new one—is a balance transfer. Credit card balance transfers are typically used by. The Paysend money transfer app is fast, simple and secure, allowing you to make card-to-card transfers to any Visa, MasterCard or Union Pay card. You can pull cash out of prepaid cards at an ATM, stores that let you take cash back or at participating financial institutions. Written by Anna Yen Anna Yen. How do I link a debit card to my One Cash account? · Select Cash Control · Choose Transfer funds · Click on Select Account · Click on Debit cards · Select Add a. If you have credit card debt on multiple cards, it can be a good idea to consolidate all those balances to one balance transfer card to save money on interest. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. A bank can assist with many types of transfers. If you're simply transferring money from one account to another within the same financial institution, this is. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. Step 1: Enter a send amount. Step 2: Choose Debit Card Deposit. Step 3: Enter your recipient's Visa or MasterCard debit card number and expiration date on our. Moving outstanding debt on one credit card to another card—usually a new one—is a balance transfer. Credit card balance transfers are typically used by.

If you have the recipient's account number and routing number, there is another way you can transfer money from your bank account into that account. A. Find out if a balance transferFootnote 1 is right for you. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells. You get access to different payment networks across the globe, all through one digital hub send and receive funds domestically to friends and family typically. You can complete an external transfer in person at your bank's local branch over the phone or online by visiting your bank's website or logging into your bank. From old-fashioned checks to new-fashioned apps and online bank transfers, there's a way to transfer money that will suit your timeframe, budget and other. Quickly transfer money from another debit card to GO2bank for a small fee. Or transfer from another bank account for free. See details at gb2012.ru You generally can't transfer balances from one to card to another from the same provider or open balance transfer card accounts with companies you already have. When you transfer money from your Apple Cash1 card, you can either use a After deleting, you can add your bank information again or add different information. You can send money to your receiver's debit or credit1 card by choosing to pay with either a bank card, Sofort, or bank transfer. You can also use Apple Pay® on. Bank-to-bank money transfer A wire transfer is a safe way to transfer money from one bank to another. Traditional bank wire transfers are often used for. Choose 'Visa Direct' as the receiving method. This will transfer money to the bank account linked to your loved one's Visa debit card. This option is only. There is no such thing as transferring money from one card to another. Each card uses the funds from the main account. Upvote 7. Downvote Award. gb2012.ru transfer service, makes possible to transfer money from card to card on-line. The service is available for Visa, Visa Electron, Mastercard. Step one Sign in to the Chase Mobile® app and tap "Pay & Transfer" · Step two Tap "Transfer" and then choose "Account or Brokerage Transfer" · Step three Enter. You can transfer money from one bank to another via an electronic transfer. Both accounts could be yours, or one could belong to someone you're paying. You can. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. Bank-to-bank money transfer A wire transfer is a safe way to transfer money from one bank to another. Traditional bank wire transfers are often used for. Yes. Once you've confirmed your email address, you can transfer money to any eligible Visa or Mastercard debit card. With this information in hand, you can either call the customer service line for the transfer card or log into your online account to complete the transfer. The. You can send money to your receiver's debit or credit1 card by choosing to pay with either a bank card, Sofort, or bank transfer. You can also use Apple Pay® on.

How Much Balance Transfer Can I Get

Here's how it works: If you have credit card debt on high-interest credit cards, you can transfer that debt to a 0% introductory annual percentage rate balance. You can transfer balances totaling up to your transfer limit. Your transfer limit is equal to 95% of your credit limit less any other balances. You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The. Chest full of money: How a balance transfer can save you thousands. Let's say you have a $5, balance on a credit card that charges % APR. If you. If you're struggling with credit card debt, completing a balance transfer can be a smart way to pay off debt without the big interest charges. Americans carry. One of the most frustrating things about credit card debt is that a high annual percentage rate can make it difficult to reduce your principal balance. How can I find the best balance transfer credit card? Savings vary based on account usage and payment behavior. The 8% cash back on Capital One. How Much Will It Cost to Transfer a $1, Balance? It depends on the credit card and institution. You might have a 3% ($30) or 5% ($50) transfer fee or have. Balance transfer cons · You may have to pay fees. Many balance transfers will charge a fee, which is typically three to five percent of the amount you're. Here's how it works: If you have credit card debt on high-interest credit cards, you can transfer that debt to a 0% introductory annual percentage rate balance. You can transfer balances totaling up to your transfer limit. Your transfer limit is equal to 95% of your credit limit less any other balances. You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The. Chest full of money: How a balance transfer can save you thousands. Let's say you have a $5, balance on a credit card that charges % APR. If you. If you're struggling with credit card debt, completing a balance transfer can be a smart way to pay off debt without the big interest charges. Americans carry. One of the most frustrating things about credit card debt is that a high annual percentage rate can make it difficult to reduce your principal balance. How can I find the best balance transfer credit card? Savings vary based on account usage and payment behavior. The 8% cash back on Capital One. How Much Will It Cost to Transfer a $1, Balance? It depends on the credit card and institution. You might have a 3% ($30) or 5% ($50) transfer fee or have. Balance transfer cons · You may have to pay fees. Many balance transfers will charge a fee, which is typically three to five percent of the amount you're.

That limit is 10 pending balance transfers. Once a pending balance has cleared, you can exceed If I have outstanding balance transfers from a previous year. If you can't get a loan, you might need to do multiple balance transfers to pay this debt off. Every time you do a balance transfer, you incur a. Compare our cards below to find a great balance transfer credit card. Browse How do credit card balance transfers work? Credit card balance. Credit card balance transfers are designed to help you save money when you have high-interest credit card debt. Federal Reserve data put the average credit. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. How do 0% APR credit cards work? How much available credit should you have? APR calculator. Rewards. How to choose a rewards credit card · Are rewards credit. Consumer Cards (Business Cards and Secured Cards are ineligible) may have up to 10 individual balance transfers open at any given time period. The minimum. Balance transfers can also simplify bills by consolidating several balances with different creditors onto one card with one payment. Say you have a credit card. You can make fewer monthly payments and keep track of debt more easily. Crossed Out Cash with Dollar Sign. No Ongoing Balance Transfer Fee. Many cards charge a. Some cards have zero balance transfer fees, but the cards with the longest promotional periods usually have fees. How much can you save with a balance transfer? If you're looking for a high-limit balance transfer credit card, you'll have better luck with a high credit score. Apply with a credit score in the good to. The one thing you won't know until you are approved for a card is how big your credit limit will be. If you don't qualify for the amount you need, you'll have. How do 0% APR credit cards work? How much available credit should you have? APR calculator. Rewards. How to choose a rewards credit card · Are rewards credit. Frequently lowers interest payments. Many balance transfer credit cards have introductory interest rates as low as 0%. · May accelerate debt repayment. If you. With a balance transfer, you can And if your current card rates are introductory, come see us when those rates end to find out how much money you can save. Balance transfers can also reduce what you have to pay in interest, even if only temporarily, and allow you to pay down the principal balance of your debt much. Balance transfers can have positive credit score effects if you open a single new card with a low APR and make an effort to reduce your debt. Check your credit score. · Decide how much you want to transfer. · Make a payoff plan. · Be aware of balance transfer fees. · Shop around for free balance transfer. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. High interest rates can make you feel stuck, but the good news is that many balance transfer credit cards offer low introductory interest rates and can help you.

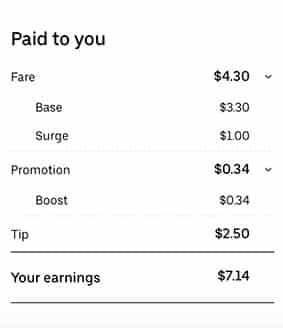

How Does The Pay Work For Uber Eats

Uber Eats distribution of payments are issued weekly via direct deposit into your bank account. The Uber Eats remittance period runs in your time zone from. How a delivery works. Ready to start delivering? Understanding how deliveries work and what to expect can help make for an easier, stress-. UberEATS drivers are paid for each delivery based on a pickup fee, drop-off fee, and mileage fee. Below is a simple formula that can be used to calculate how. As of Aug 23, , the average hourly pay for an Uber Eats Delivery Driver in California is $ an hour. While ZipRecruiter is seeing salaries as high as. 25% down payment then three payments of 25% every two weeks for 6 weeks. Options depend on your purchase amount, may vary by merchant, and may not be available. The base fares Uber Eats pay range from $2 to $4 The base amount an Uber Eats driver receives for a delivery is calculated based on the estimated delivery. Fares are calculated based on the estimated time and distance to complete a trip. The time element includes the total amount of time from accepting the. Sometimes the Driver does pay for your order. Uber gives us drivers a credit card. Sometimes the card does not work. I had this happen on. You can receive payments in three ways: Weekly deposits directly to your bank account. Each weekly pay period begins on Monday at 4 AM and ends on the following. Uber Eats distribution of payments are issued weekly via direct deposit into your bank account. The Uber Eats remittance period runs in your time zone from. How a delivery works. Ready to start delivering? Understanding how deliveries work and what to expect can help make for an easier, stress-. UberEATS drivers are paid for each delivery based on a pickup fee, drop-off fee, and mileage fee. Below is a simple formula that can be used to calculate how. As of Aug 23, , the average hourly pay for an Uber Eats Delivery Driver in California is $ an hour. While ZipRecruiter is seeing salaries as high as. 25% down payment then three payments of 25% every two weeks for 6 weeks. Options depend on your purchase amount, may vary by merchant, and may not be available. The base fares Uber Eats pay range from $2 to $4 The base amount an Uber Eats driver receives for a delivery is calculated based on the estimated delivery. Fares are calculated based on the estimated time and distance to complete a trip. The time element includes the total amount of time from accepting the. Sometimes the Driver does pay for your order. Uber gives us drivers a credit card. Sometimes the card does not work. I had this happen on. You can receive payments in three ways: Weekly deposits directly to your bank account. Each weekly pay period begins on Monday at 4 AM and ends on the following.

Uber Eats drivers earn between $ and $ per hour, with annual incomes ranging from about $26, to $41, for full-time work. · Earnings depend on. Then, you'll pay with your pre-authorized Plus Card and deliver the items to your customer. You can also use your own card at checkout and get reimbursed. While Uber Eats provides much more clear-cut rates for their delivery drivers, Uber's driver rates are not so clear, as a number of factors affect the pay a. In the case of UberEATS, if you earn at least $20, in delivery transactions (delivery fees and customer tips) and complete at least deliveries in a. The payment for services provided on your Uber Eats account will be made to your bank account using the normal payment method and you are responsible for paying. How much do Uber Eats Driver jobs pay per hour? The average hourly pay for a Uber Eats Driver job in the US is $ Hourly salary range is $ to. The driver gets electronic payment into their account when the order is marked completed. Any tip is allowed to be adjusted by the customer for. The average UberEATS Delivery Driver base salary at Uber is $19 per hour. The average additional pay is $0 per hour, which could include cash bonus, stock. How Does Uber Pay Their Fast Food Delivery Drivers? · Weekly deposits direct to your bank account · Instant Cashout · Two-day Cashout. You can use the same payment methods you use on Uber trips. Track order. Track. Follow your order in the app. First you'll see the restaurant accept and start. Can I pay in cash? Uber Eats is designed to be a cashless experience. All payments occur within the app using the card you have on file. The only exception is. Link your bank account for a free scheduled payout once a week · To do this, open the menu in your app and tap Wallet, then Payment Method and Add bank account. Want to know how much Uber Eats Pays? Drivers earn $18 per hour on average. It's a great way to get paid fast and set your own schedule. You can work for one hour, several hours, on weekends or several days throughout the week. Payout is immediate. When you drive with Uber Eats, your earnings are. Uber Eats pays based on your time elapsed and per mile. As such, while apps such as DoorDash usually pay based on the order value, Uber Eats typically pays. When working with Uber Eats, you can expect your earnings in a given pay period to equal the total retail price of all items (including sales taxes) minus. When working with Uber Eats, you can expect your earnings in a given pay period to equal the total retail price of all items (including sales taxes) minus. How much do Uber Eats Delivery Driver jobs pay per hour? Average hourly salary for a Uber Eats Delivery Driver job in the US is $ DO MORE ORDERS EQUAL MORE MONEY? · Pick up: As an Uber Eats driver, you'll get paid a flat rate for collecting the order from the restaurant in question. · Drop.

Best Credit Card For One Large Purchase

Few credit cards can keep up with the cash back earn rate of the Scotia Momentum® Visa Infinite* card. However, there is one major downside: your cash back. Whether this is true or not, it is a good rule of thumb to follow. I make two payments on my credit card. One before the Payment Date - in full. For all purchases made by Prime members at gb2012.ru, Amazon Fresh, and Whole Foods, you get a robust 5% cash back. That's one of the key reasons this card was. Large purchase credit cards · Usually come with an introductory offer rate on purchases. · Could be a good way of paying for planned bigger items or projects. Qualifying purchases exclude purchases made on promotional credit plans. Your CreditWise score is a good measure of your overall credit health, but. Credit cards can be an excellent tool for building credit when you're financing purchases both big and small. In addition, most credit cards today deliver. Created with Sketch. 3% cash back at U.S. supermarkets on up to $6K in purchases . For example, Navy Federal Credit Union's nRewards® Secured card offers point rewards while you build your credit, with the potential to upgrade to cashRewards. Citi Simplicity® Card · reviews · 0% for 21 Months. Regular balance transfer APR. % - %* Variable. Balance transfer fee ; Capital One Venture Rewards. Few credit cards can keep up with the cash back earn rate of the Scotia Momentum® Visa Infinite* card. However, there is one major downside: your cash back. Whether this is true or not, it is a good rule of thumb to follow. I make two payments on my credit card. One before the Payment Date - in full. For all purchases made by Prime members at gb2012.ru, Amazon Fresh, and Whole Foods, you get a robust 5% cash back. That's one of the key reasons this card was. Large purchase credit cards · Usually come with an introductory offer rate on purchases. · Could be a good way of paying for planned bigger items or projects. Qualifying purchases exclude purchases made on promotional credit plans. Your CreditWise score is a good measure of your overall credit health, but. Credit cards can be an excellent tool for building credit when you're financing purchases both big and small. In addition, most credit cards today deliver. Created with Sketch. 3% cash back at U.S. supermarkets on up to $6K in purchases . For example, Navy Federal Credit Union's nRewards® Secured card offers point rewards while you build your credit, with the potential to upgrade to cashRewards. Citi Simplicity® Card · reviews · 0% for 21 Months. Regular balance transfer APR. % - %* Variable. Balance transfer fee ; Capital One Venture Rewards.

You'll earn 2% in cash rewards on purchases, with no limit to.

For transferrable rewards, the Capital One Venture X is tops; for travel perks, we like the Amex Platinum Card®; and for the best starter travel card, go for. For transferrable rewards, the Capital One Venture X is tops; for travel perks, we like the Amex Platinum Card®; and for the best starter travel card, go for. Visa® Platinum Card Save on interest with a great low introductory rate for an extended time. Use for large purchases, unexpected expenses or last-minute. Featured credit card offers · U.S. BANK CASH+ ® VISA SIGNATURE ® CARD · U.S. BANK ALTITUDE ® GO VISA SIGNATURE ® CARD · U.S. BANK VISA ® PLATINUM CARD · U.S. BANK. Good-Excellent Credit. Earn a $ REI gift card after your first purchase outside of REI within 60 days of account opening. Only co-op members can apply. Visa® Platinum Card · Save on interest with a great low introductory rate for an extended time. · Use for large purchases, unexpected expenses or last-minute. Table of contents · American Express Platinum Card · Scotiabank Platinum American Express · TD Aeroplan Visa Infinite Privilege · RBC Avion Visa Infinite Privilege. Find the best credit card by American Express for your needs. Choose between travel, cash back, rewards and more. Apply for a credit card online. You have a current balance on a card that you want to pay down. · You have a large purchase to make and need extra time to pay it off. · Earning rewards isn't. Visa® Platinum Card · Save on interest with a great low introductory rate for an extended time. · Use for large purchases, unexpected expenses or last-minute. The way to maximize credit card rewards is to take advantage of the best credit card welcome offers and also to use the cards with the best bonus categories. Capital One Quicksilver Cash Rewards Credit Card Earning cash back is easy with this card thanks to unlimited % Cash Back on every purchase, every day and. Support our channel by choosing your next credit card using one of the card links at: BEST FOR LARGE PURCHASES. best to pay as much as you can each month. A credit card can be a great way to break large purchases into smaller, more manageable payments. However, carrying a. However, the best credit card to finance large purchase decisions in the travel world is the prestigious Business Platinum Card offered by American Express. Earn 1% cash back on all purchases. No expiration date on cashback rewards; Capital One Lounge access; Credit for Global Entry or TSA Pre✓®. Best cashback credit cards The CIMB World Mastercard is a great choice if luxury goods and dining are a mainstay in your monthly to-buy list. There's no limit. Paying your debts multiple times per month. Similarly, making payments toward a large debt multiple times in one month may be beneficial to your credit scores. 45 partner offers ; Capital One VentureOne Rewards for Good Credit · N/A · x-5x (Miles per dollar) · % (Variable) ; Capital One Quicksilver Cash Rewards for.