gb2012.ru

Tools

How To Lose Weight In 16 Days

The Day Weight Loss Jump Start: Lose 15 To 19 Pounds In 16 Days! - Kindle edition by Wilson, Howard T.. Download it once and read it on your Kindle. The best way to lose weight is slowly, by making small, achievable days, alternate weeks or certain times of the day. (For example, following a For fast-but-safe weight loss, the best strategy is to cut down on carbs, fill up on protein and reduce your calorie intake. High-intensity workouts can also. You don't have to cut out snacks in order to eat a healthy diet, either. Healthy snacks for weight loss include almonds or pistachios, string cheese with an. You need to eat a bare minimum of cals a day unless told otherwise by a medical professional. Toddlers are recommended to eat gb2012.ru: Lose 16 Pounds in Days on a Smoothie Cleanse Diet: Rapidly Lose Weight, Fight Cancerous Diseases, and Look Younger Whilst Drinking a. 16/8 intermittent fasting involves limiting your intake of foods and calorie-containing beverages to a set window of 8 hours per day. Eat a Large Breakfast and a Small Dinner “You'll want to take in more of your calories earlier in the day. A study published in found that subjects who. Lose weight consistently by following a calorie-deficit diet—this is when you burn more calories than you intake within a day. Eat a diet that's rich in whole. The Day Weight Loss Jump Start: Lose 15 To 19 Pounds In 16 Days! - Kindle edition by Wilson, Howard T.. Download it once and read it on your Kindle. The best way to lose weight is slowly, by making small, achievable days, alternate weeks or certain times of the day. (For example, following a For fast-but-safe weight loss, the best strategy is to cut down on carbs, fill up on protein and reduce your calorie intake. High-intensity workouts can also. You don't have to cut out snacks in order to eat a healthy diet, either. Healthy snacks for weight loss include almonds or pistachios, string cheese with an. You need to eat a bare minimum of cals a day unless told otherwise by a medical professional. Toddlers are recommended to eat gb2012.ru: Lose 16 Pounds in Days on a Smoothie Cleanse Diet: Rapidly Lose Weight, Fight Cancerous Diseases, and Look Younger Whilst Drinking a. 16/8 intermittent fasting involves limiting your intake of foods and calorie-containing beverages to a set window of 8 hours per day. Eat a Large Breakfast and a Small Dinner “You'll want to take in more of your calories earlier in the day. A study published in found that subjects who. Lose weight consistently by following a calorie-deficit diet—this is when you burn more calories than you intake within a day. Eat a diet that's rich in whole.

Currently, most people try to lose weight by restricting how many calories they eat each day. 16 or 18 hours a day have a higher risk of gallstones. To lose more weight, you need to either increase your physical activity or decrease the calories you eat. Using the same approach that worked at first may. There are a lot of weight management programs that now fall into the category of intermittent fasting including the high profile , the and alternate day. 16 mistakes to avoid when trying to lose weight · 1. · Eat plenty of vegetables, fruits, and whole grains throughout the day to get more fiber and other important. You can start losing weight by cutting junk food from your diet. Add in small portions of lean protein, fruits, and vegetables to your diet. Exercise regularly. For fast-but-safe weight loss, the best strategy is to cut down on carbs, fill up on protein and reduce your calorie intake. High-intensity workouts can also. Page Losing weight - getting started. Workplace diet traps. We spend on average about a third of our day at work, so it makes sense to give what we eat. Find other ways to fit activity into your day. Walk to school, jog up and down the stairs a couple of times before your morning shower, help your parents in the. Drink low-fat milk and water instead of sugary drinks. Eat at least 5 servings a day of fruits and veggies. Include a variety protein in your diet. Protein. Page Losing weight - getting started. Workplace diet traps. We spend on average about a third of our day at work, so it makes sense to give what we eat. YES! You can indeed see lose weight loss results in as early as 2 weeks! With continuous workout and a healthy diet, you can burn up to 6kg. During the diet, males fast for 16 hours each day, and females fast for 14 hours. The amount of weight someone can lose with intermittent fasting depends. Start your day right with a healthy breakfast, such as 3/4 cup to 1 1/2 cups of unsweetened whole-grain cereal with 1 cup of nonfat milk or a milk alternative. How To Lose Weight In 30 Days: 7 Things To Do Before You Start Your Journey · 1. Join a Structured Weight Loss Program · 2. Set a Day Goal · 3. Purchase a. Making small, simple changes to what and how much you are eating and drinking can really help you lose the pounds. On this page. Download the free NHS Weight. Setting realistic goals is one of the best ways to lose weight and keep it off for good. Forget about “quick weight loss” promises. With that in mind, if you consistently eat at a deficit of calories a day you can expect to lose a pound a week, which is a good number to aim for. Losing. Most people gain and lose a little weight from day to day, but these changes tend to stay within a five-pound range. However, if you've lost more than that. Young men who fasted for 16 hours showed fat loss while maintaining muscle mass. Mice who were fed on alternate days showed better endurance in running. Since food equals calories, in order to lose weight you must either eat fewer calories, exercise more to burn off calories with activity, or both.

Fees Financial Advisors Charge

:max_bytes(150000):strip_icc()/ways-financial-advisors-charge-fees-2388441_V1-b9356000e6194c3ebced21e583eb23f0.jpg)

Most financial advisors charge a fee based on a fixed percentage of the total value of your investment portfolio. The industry-average is 1% of your portfolio. The average advisor fees charged by brokerage range from % to %, depending on client assets. In general, average advisor fees have been coming down. You need a "fee-only" advisor because they can't take commissions. That fee can be a flat fee, hourly rate, or a percentage of assets under. "Fee-only financial planners are registered investment advisors with a fiduciary responsibility to act in their clients' best interest. They do not accept any. Hourly. If you are willing to take advice and make it happen by yourself, hourly is a great way to work with a financial advisor. · Retainer Fee. Sometimes, you. Wheaton IL fee-only financial planning services and estimated hourly costs packaged to fit different client needs and budgets. Read about our fee structure. Usually Financial advisors charge 1% of your Gross Portfolio value per year. And usually they guarantee a return of about 7% return on your. How much does it cost to work with an Ameriprise financial advisor? Each relationship with a new client begins with a complimentary consultation where you. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. All NAPFA members are. Most financial advisors charge a fee based on a fixed percentage of the total value of your investment portfolio. The industry-average is 1% of your portfolio. The average advisor fees charged by brokerage range from % to %, depending on client assets. In general, average advisor fees have been coming down. You need a "fee-only" advisor because they can't take commissions. That fee can be a flat fee, hourly rate, or a percentage of assets under. "Fee-only financial planners are registered investment advisors with a fiduciary responsibility to act in their clients' best interest. They do not accept any. Hourly. If you are willing to take advice and make it happen by yourself, hourly is a great way to work with a financial advisor. · Retainer Fee. Sometimes, you. Wheaton IL fee-only financial planning services and estimated hourly costs packaged to fit different client needs and budgets. Read about our fee structure. Usually Financial advisors charge 1% of your Gross Portfolio value per year. And usually they guarantee a return of about 7% return on your. How much does it cost to work with an Ameriprise financial advisor? Each relationship with a new client begins with a complimentary consultation where you. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. All NAPFA members are.

Financial advisors may also charge a flat fee, hourly rate or single fee for each financial project you create — such as a college savings fund or retirement. This fee structure causes fees to grow exponentially as your wealth increases. For example, assume you have $3,, invested with a traditional Wall Street. The cost of working with a fee-only Assets Under Management (AUM) advisor is typically % - % of invested assets each year. Fees are usually billed every. Most advisors require a lower fee the more money they are managing for you, and vice versa. A better question to ask is, “Is that fee fair for. Commissions and sales charges when you buy and sell investments, generally ranging from % to %, which may be lower and vary based on the type and amount. Your Financial Advisor may receive a fee for placing certain non-mortgage loans with third-party lenders. The fees vary according to the specific third-party. Flat fee advisors will typically charge somewhere between $2,$10,+ per year. The lower the fee, the less complex the project, and vice versa. The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the. The average percentage, based on the number of assets under management (AUM) for ongoing advising, is about 1% annually, but an advisor may charge less if you. The fees charged by a competent investment advisor are no different than those charged by a good accountant or an attorney. You are simply paying for a service. How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. Use this calculator to compare the cost of your financial advisor with Range, a fee-only fiduciary. As we've discussed in other blogs about the cost of financial advice, high fees are destructive to the long term creation of wealth. If you had a $1MM portfolio. There are three primary ways financial advisors are compensated: • Fee only: An advisory fee based on a percentage of assets under management. The advisory fee. What percentage do most financial advisors charge? The typical fee has held steady at roughly 1% on the first $1 million of assets each year. But some advisors. A fee-only financial advisor might charge a flat fee, normally from $1, to $5, They may charge hourly fees of $ to $, or a percentage fee, normally. The cost of a financial advisors based on their fee-model · $ to $ an hour/ $1, to $3, per plan/ % to % of AUM · 3% to 6% of the investment. Fee-Only Charges · Flat-rate fees range from $2, to $10, for a one-time charge. · Hourly fees can range anywhere from $ to $ per hour, so how much a. It is important to note, that a substantial number of financial planners charged more than 1% for clients with less than $, The median fee for $, Flat Fees: Depending on complexity, some advisors charge a flat fee for specific services, ranging from a few hundred to several thousand dollars. Hourly Rates.

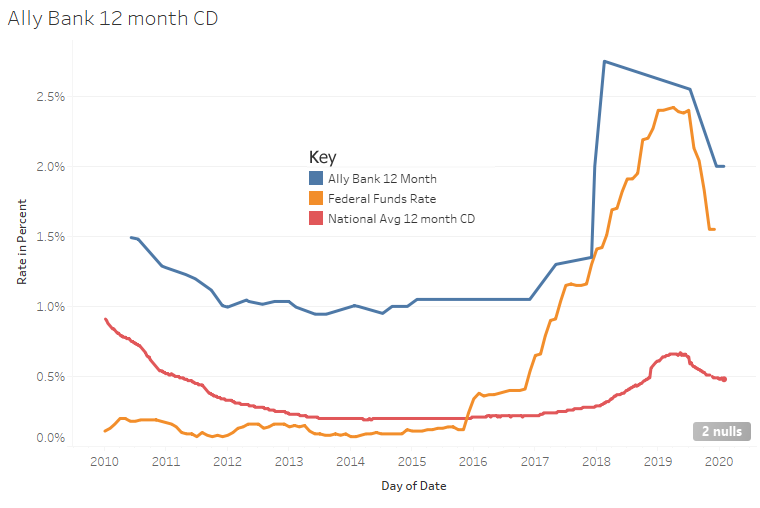

Historical Bank Cd Rates

Monthly Rate Cap Information as of August 19, ; 1 month CD, , ; 3 month CD, , ; 6 month CD, , ; 12 month CD, , TD Bank CD rates ; TD Choice Promotional CD, 18 months, % APY ; TD Choice Promotional CD, 2 years, % APY ; TD Choice Promotional CD, 3 years, % APY ; TD. Best CD rates of August (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Synchrony Bank — 3 months. The Fed funds rate impacts most of the country's interest rates including loans, bonds, and, indirectly, bank CD yields. A CD is a savings account that holds a fixed amount of money for a fixed period of time, and in exchange, the issuing bank pays interest. When you redeem. We offer a a CD ladder calculator below. Make Your Money Work Harder! Is your bank offering competitive rates which beat inflation and taxes? If not, you. Federal Deposit Insurance Corporation, Treasury Yield: Month CD [TY12MCD], retrieved from FRED, Federal Reserve Bank of St. Saving Accounts Interest Rates. Historical Promotional CD Terms. The promotional terms on this page are for personal, business, and Key Private Bank CDs. CD rates averaged % throughout the decade, although the rates on six-month CDs fell to % during , again to % in , and then bottomed out at. Monthly Rate Cap Information as of August 19, ; 1 month CD, , ; 3 month CD, , ; 6 month CD, , ; 12 month CD, , TD Bank CD rates ; TD Choice Promotional CD, 18 months, % APY ; TD Choice Promotional CD, 2 years, % APY ; TD Choice Promotional CD, 3 years, % APY ; TD. Best CD rates of August (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Synchrony Bank — 3 months. The Fed funds rate impacts most of the country's interest rates including loans, bonds, and, indirectly, bank CD yields. A CD is a savings account that holds a fixed amount of money for a fixed period of time, and in exchange, the issuing bank pays interest. When you redeem. We offer a a CD ladder calculator below. Make Your Money Work Harder! Is your bank offering competitive rates which beat inflation and taxes? If not, you. Federal Deposit Insurance Corporation, Treasury Yield: Month CD [TY12MCD], retrieved from FRED, Federal Reserve Bank of St. Saving Accounts Interest Rates. Historical Promotional CD Terms. The promotional terms on this page are for personal, business, and Key Private Bank CDs. CD rates averaged % throughout the decade, although the rates on six-month CDs fell to % during , again to % in , and then bottomed out at.

FDIC Approves the Deposit Insurance and Merger Applications for Thrivent Bank, Salt Lake City, Historical Rates Revised Rule - Excel (XLSX). Prior Rule . To demonstrate rate trends over time, we track the rate history of the average 1-year CDs from all banks and credit unions. In addition, we track the rate. A CD is a savings account that holds a fixed amount of money for a fixed period of time, and in exchange, the issuing bank pays interest. When you redeem. Transaction History · Leadership Team · Industry Insight · Subscription Center Banks typically offer higher interest rates on callable CDs than on non. National Deposit Rates: 6-Month CD. Percent, Monthly, Not Seasonally AdjustedApr to Aug (Aug 19). Average Rate on 1-Month Negotiable Certificates of. Considered the most competitive U.S. Bank CD, CD Specials come complete with promotional rates and great returns. history), digital network activity. Credit Human – % APY · Apple Federal Credit Union – % APY · First National Bank of America – % APY · Discover Bank – % APY · gb2012.ru –. US 1-Year CD Rate is at %, compared to % last month and % last year. This is higher than the long term average of %. 5-year CD yield: percent APY. Beyond Rates: Strategic Savings with CDs: Understanding historical trends, current rates, and inflation expectations is. CD rates have been relatively flat for the past decade; interest rates were at historic lows because of Fed rate cuts following the Great Recession. At the end. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. The rate reported is that for the Federal Reserve Bank of New York. Historical series for the rate on adjustment credit as well as the rate on primary. What was the highest CD rate in history? The all-time high for CD interest rates was in December , when CD rates reached an average of %. When was. Personal CD Rates ; 1 year, %, % ; 15 month, %, % ; 18 month, %, % ; 2 year, %, %. EverBank Performance℠ CDs · 1 year, %. year, % · 2 year, %. year, % · 3 year, % · 4 year, % · 5 year. Historical Promotional CD Terms. The promotional terms on this page are for personal, business, and Key Private Bank CDs. Bask Certificate of Deposit Accounts must be funded with a minimum deposit of $1, within 10 business days of account opening. Interest for CDs is calculated. We offer a variety of FDIC-insured brokered CDs with different maturity terms and rates. Find the right one for you. ; months, % ; months, %. Historical CD rates for 3-year CDs have been %, 4-year CDs have been %, and 5-year CDs have been %. That is up to a full percentage point. CD Rates. Term, Interest Rate, APY. 3 Month CD, %, %. 6 Month CD, %, %. 9 Month CD, %, %. 12 Month CD, %, %. 18 Month CD, %.